[

]

Intuit, the company behind TurboTax, Credit Karma, QuickBooks and Mailchimp, announced a “multi-year, strategic partnership” with stablecoin issuer Circle involving its stablecoin infrastructure and USDC (USDC).

In a Thursday notice, Intuit said the agreement with Circle would allow “faster, lower-cost” payments through their platforms, which focus on business transactions, tax refunds and marketing. According to Circle CEO Jeremy Allaire, the deal will “extend the speed, power and efficiency of USDC for everyday financial transactions.”

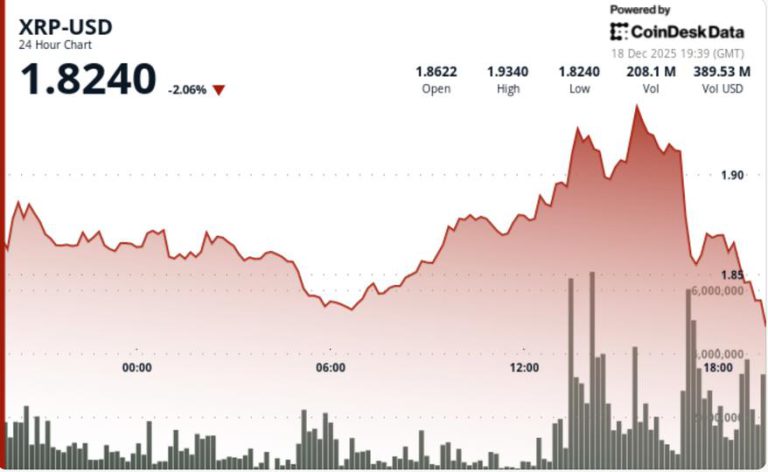

USDC is the second-largest stablecoin by market capitalization, trailing Tether’s USDt (USDT) by more than $186 billion. According to data from Nansen, USDC’s market cap was more than $77 billion at the time of publication.

The stablecoin market in the United States, following the passage of the GENIUS Act in Congress, is expected to grow considerably as regulations smooth the path for issuers looking to the coins as solutions for payments and other financial transactions. US agencies are establishing guidelines in accordance with the bill before final implementation.

Related: Stablecoins break $300B market cap, post 47% growth year-to-date

The announcement referred to the stablecoins being “embedded across the Intuit platform.” Cointelegraph reached out to Intuit for comment on the potential rollout, but had not received a response at the time of publication.

Circle and others approved for US bank charters

The Intuit partnership followed the US Office of the Comptroller of the Currency (OCC)’s conditional approval of Circle for a national trust bank charter in a landmark decision for crypto companies.

Ripple received a similar approval for its application, and the OCC greenlit BitGo, Fidelity Digital Assets and Paxos, converting their existing state-level trust companies into federally chartered national trust banks.

Magazine: When privacy and AML laws conflict: Crypto projects’ impossible choice

[

]